tax lien sales in el paso tx

You are advised to research and if possible accomplish a site inspection of any parcel s prior to submitting an assignment request. WRONGFULLY SOLD LIEN If a lien is wrongfully sold and the County must pay the certificate holder the redemption interest the rate will be calculated as set forth in Section 39-12-111 Colorado Revised Statutes.

Taxes On Sale Of A Home In Texas What To Consider

Good morning today were going to be talking about text Deed Foreclosures in Texas and specifically in El Paso County.

. Full rights to El Paso Texas property sold at a El Paso County Texas delinquent tax sale generally do not. As an example lets say Joe Homeowner owes 10000 in past due property taxes owed to a Texas county. Detailed listings of foreclosures short sales auction homes land bank properties.

Sale Day 900 - 1100 AM. There are currently 55 red-hot tax lien listings in El Paso TX. El Passo TX 79901 Phone.

2021 property taxes are due and may be paid from today through Monday January 31 2022 but we recommend payment well before January 31st. El Paso Tx 79927 tax liens available in TX. Ad Compare foreclosed homes for sale near you by neighborhood price size schools more.

What are the steps for buying a tax deed for closure. Investing in tax liens in El Paso County TX is one of the least publicized. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more.

Paisano El Paso Texas 79905. UPDATE - Order of Sale Added. Enjoy the pride of homeownership for less than it costs to rent before its too late.

Sales are currently being conducted at the El Paso County Coliseum located 4100 E. Registration of bidders begins at 830 am. Taxes leading to foreclosure can include property taxes city taxes hospital taxes and school taxes as well as city liens placed against the property by the city.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in El Paso County TX at tax lien auctions or online distressed asset sales. Ad Find Tax Lien Property Under Market Value in El Paso. El Paso County Tax Lien Sales Podcast Transcript.

Successful purchasers at the El Paso County Texas tax deed sale receive a Texas Texas tax deed. Buy Tax Delinquent Homes and Save Up to 50. El Paso County Courthouse 500 E.

Our office hours are Monday through Friday 800 am. The El Paso County Texas tax sale is held the first Tuesday of each month at. The listed sales are for the Sheriffs Office only and do not include sales by the Constables Offices or other El Paso County Offices.

The El Paso County held tax lien list consists of tax liens not purchased by investors at the public auction. What are the steps for buying a tax deed for closure. Civil Process Home - Sheriffs Sale Information - Sheriff Sales - Civil Process Fees.

Tax Sales are to be conducted with real property designated by the City of El Paso Tax Office on the first Tuesday of each month at 1000 am or if the first Tuesday of a month occurs on January 1 or July 4 between 10 am. Ad Find Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More. This channel may contain copyrighted material the use of which has not been specifically authorized by the copyright holders.

Compare Tax Lien in El Paso TX. Buying Tax Liens in Texas. On the first Wednesday of the.

Register for 1 to See All Listings Online. Taxes leading to foreclosure can include property taxes city taxes hospital. These tax foreclosed homes are available for pennies on the dollar - as much as 75 percent off full market price and more.

There are currently 1250 red-hot tax lien listings in El Paso TX. These liens are available for assignment by submitting a written request to the El Paso County Treasurers Office. In Texas even though you may hear of a sale referred to as a Texas Tax Lien Sale a buyer is not buying a lien but is actually buying the deed to a property at a Sheriff Sale.

Investing in tax liens in El Paso TX is one of the least publicized but safest ways to make money in real estate. Instruction as to bid amount will be covered by the officer conducting the sale. El Paso TX currently has 988 tax liens available as of February 3.

Access business information offers and more - THE REAL YELLOW PAGES. Should you need more information than what is provided in this website please call 915 212-0106 or contact citytaxofficeelpasotexasgov. These one-in-a-lifetime real estate deals are that good.

Sales must be held from 10AM to 4PM. In fact the rate of return on property tax liens investments in El Paso TX can be anywhere between 15 and 25 interest. Mary Money wins the bidding and buys the lien by paying off Joes delinquent tax debt.

Search Bank Foreclosures Auctions Short Sales REOs Pre-Foreclosures and Tax Sales. Tax delinquent propertys are sold to winning bidders state laws differ though often they are sold for the amount of unpaid taxes typically a fraction of the full market value. These buyers bid for an interest rate on the taxes owed and the right to collect back that money plus an interest payment from the property owner.

The county places a lien against the property and auctions off the lien. There are currently 100 tax lien-related investment opportunities in El Paso County TX including tax lien foreclosure properties that are either available for sale or worth pursuing. The property shall be offered for sale at public auction free and clear of all liens and interests of the parties to this action.

El Paso County makes no guarantee for the condition or marketability of any property which is acquired through a Treasurers tax deed. 12275 El Greco Circle El Paso TX 79936. Tax lien sales in el paso tx.

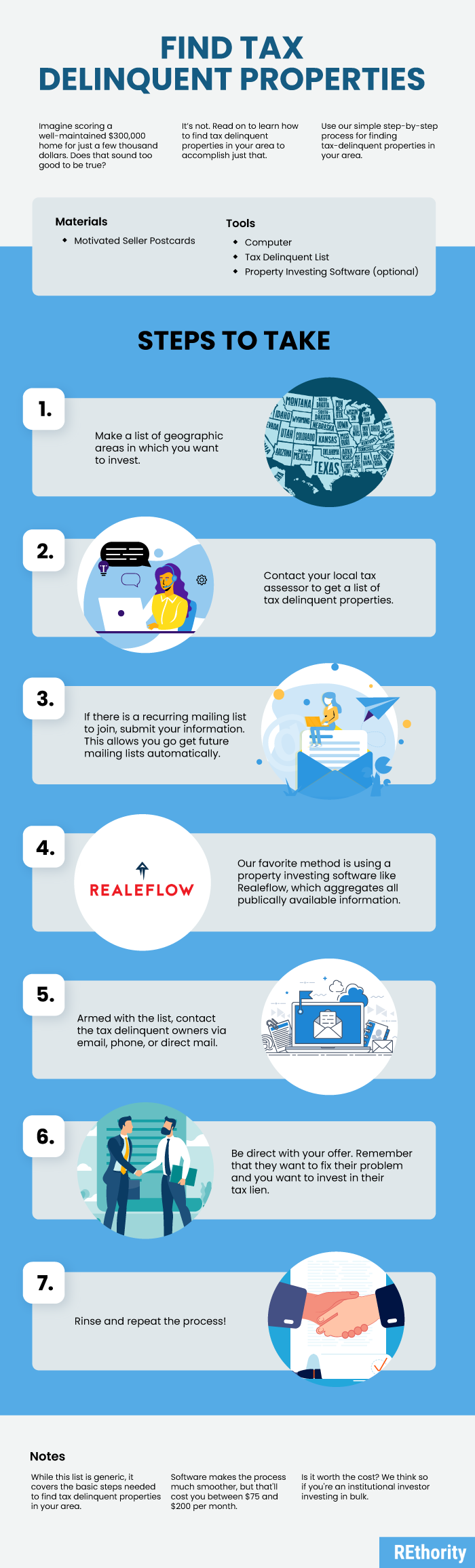

How To Find Tax Delinquent Properties In Your Area Rethority

2019 Tax Sale City Of Opelousas

Paying Property Taxes Late What Happens If You Don T Pay Property Taxes In Texas Tax Ease

Learn How To Buy Tax Lien Properties In Texas Tax Lien Certificates And Tax Deed Authority Ted Thomas

Payroll Tax Definition Payroll Taxes Payroll Tax Attorney

When Are Property Taxes Due In Texas Find The Texas Property Tax Due Dates More Tax Ease

Tax Law Attorney El Paso Tx Villegas Law Cpa Firm Irs Taxes Payroll Taxes Attorney At Law

El Paso County Delinquent Property Taxes Find Out About El Paso Property Taxes Today Tax Ease

Pin On Real Estate Attorney El Paso Tx

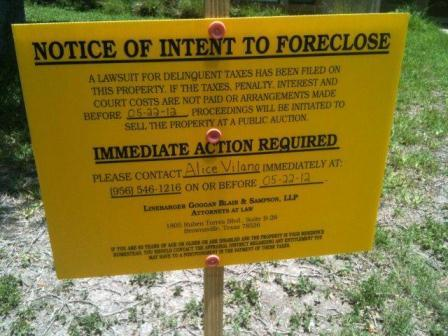

4 Ways To Stop A Property Tax Foreclosure In Texas

Property Tax Relief Available To Texas Homeowners Through Homestead Exemptions The Texas Tribune

Texas Real Estate Transfer Taxes An In Depth Guide

Texas Property Tax Loans Funding Loans For Property Taxes

How Long Can You Go Without Paying Property Taxes In Texas A Guide To How Long Property Taxes Can Go Unpaid In Texas Before For Foreclosure Tax Ease

Tax Law Attorney El Paso Tx Villegas Law Cpa Firm Irs Taxes Payroll Taxes Attorney At Law